Why Foreign Property Investors in Dubai Trust PFOC Properties to Bridge the Gap

The Strategic Imperative Why Foreign Investors are Looking to Dubai

A Global Economic Nexus and Investment Magnet

When people talk about property investment in Dubai, it usually comes back to one simple fact: location. Dubai is strategically located at the crossroads of Europe, Asia, and Africa. You can fly out in almost any direction and reach billions of consumers within a few hours. Add in one of the busiest airports in the world, linking over 240 destinations, and suddenly the city feels less like a desert outpost and more like the planet’s crossroads. But geography alone does not explain the rise. Over the last twenty years, Dubai has made a deliberate shift away from oil.

The leadership poured resources into finance, technology, tourism, and even smart-city projects. That kind of diversification does not just happen by chance. It creates an economy where foreign property investors in Dubai feel confident putting their money to work. Of course, finding the right opportunity is not always straightforward. That’s where trusted names like PFOC Properties Dubai come into play. A reputablereal estate agency in Dubai isn’t just about selling units; it’s about guiding property investors and brokers toward projects that align with their long-term goals.

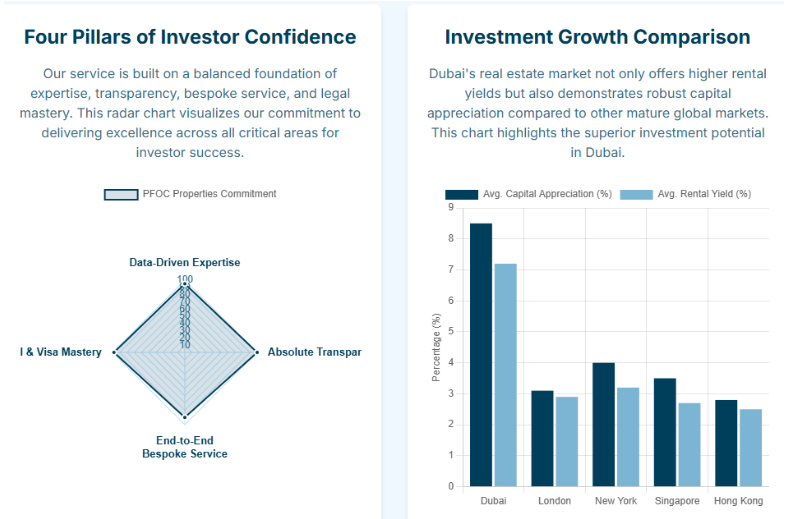

Financial Fundamentals: Unlocking High Yields and Capital Appreciation

The numbers are hard to ignore. In one nine-month stretch, the Dubai Land Department logged over 163,000 deals worth AED 544 billion. And it is not a new trend either; back in 2021, transaction values jumped by more than 70% compared to the year before. That kind of consistency is what gives investors in property development the confidence to stay. Rental yields tell the same story. Apartments in the city average about 7.4%, villas around 6%. Stack that against London, New York, or Singapore, and you see why so many investors looking to buy property keep circling back to Dubai. The numbers add up.

Why so strong? It comes down to people. The expat population keeps growing, drawn by tax breaks, lifestyle, and the chance to work in a global hub. More residents mean steady demand for rentals, and that is what keeps investors in property happy. It is a cycle: people move in, rents stay strong, and properties for investors gain long-term value. No surprise, then, that communities like the Dubai property investors group keep expanding, and heavyweight names like the Aldar Properties investor circle or the Damac Properties investor network continue to set the pace. For many, the cherry on top is the property investor visa in the UAE. It does not just secure returns; it secures residency, which is why so many are chasing it.

Case Study 1: Overseas Investor Secures High-Yield Rental with Confidence

The UK-based investor simply wished to be exposed to Dubai’s lucrative rental yields (circa 7%+) but was feeling daunted by developers and legal processes. PFOC Properties advised them on a good freehold project, did the due diligence, contracts, and DLD registration, and also set up post-purchase management. The outcome was an arsenic-compliant investment producing consistent rental income without the investor having to be physically present.

Client Quote: “PFOC made us from abroad feel that investing is safe. My property started earning right away.’” “All the details were taken care of.

A Sanctuary of Stability: Policy, Tax, and Trust

A major part of the strong Dubai property market trust comes from policies that are clear and favorable to investors. A turning point was the 2002 Freehold Law, which gave foreigners 100% ownership rights in designated zones. This allowed foreign property investors in Dubai to buy, sell, lease, and even pass properties on to heirs without needing a local sponsor. Tax policy adds another layer of attraction. There is no personal income tax, no capital gains tax on sales, and no annual property tax on residential units. For both residents and properties for investors, that is a rare global advantage and one of the key reasons Dubai continues to pull in international capital.

The government’s “Dubai Real Estate Sector Strategy 2033” strengthens this trust even further. The plan aims to double the sector’s GDP contribution and grow transactions by 70%. By using technology and AI-driven tools, authorities are shaping up a system designed to keep investing in Dubai properties simple, transparent, and profitable.

This is not just a market boom; it is deliberate, long-term engineering. Residency programs, like the Golden Visa, create a reinforcing cycle. Wealthy individuals and skilled professionals move in, demand rises, and rental yields stay strong. For the property investor, that means both stability and growth, even during times of global uncertainty. And when it comes to navigating opportunities, having property consultants Dubai by your side ensures you are investing in a market backed by strong laws, zero recurring taxes, and policies built on trust.

| Why Dubai Is an Investment Hub | Details & Key Data |

|---|---|

| Investor-Friendly Policies | 100% foreign ownership in designated freehold zones; streamlined processes and enhanced buyer protection. |

| Tax Advantages | No personal income tax, capital gains tax, or property tax on residential properties. |

| High Financial Returns | Rental yields of approximately 7.4% for apartments and 6.0% for villas; record transaction growth and capital appreciation. |

| Long-Term Residency | Investment in property can grant a renewable two-year residency visa or a 10-year Golden Visa, providing long-term security and stability. |

The International Investor’s Gauntlet – Understanding the “Gap”

The Legal and Regulatory Maze

On paper, Dubai’s property laws are straightforward. But when you are buying it, it feels different. The first obstacle? Freehold versus non-freehold. In one, you own the property outright. In the other, you do not. It sounds simple, but for many foreign property investors in Dubai, that single detail creates confusion from day one. Off-plan projects are another curveball.

They are tempting new buildings to lower prices, but delays happen, and some developers fail to deliver as promised. RERA does require escrow accounts, which is good, but rules do not replace real protection. To stay safe, Dubai real estate for foreign investors usually means leaning on Dubai property investment consultants. They know the traps, the fine print, and where hidden fees often show up. Inheritance adds yet another twist. Yes, foreigners can buy property. But when it comes to passing it on, Sharia law applies unless a proper will is in place. For the property investor, that is a legal step many overlook until it is too late.

The Financial and Logistical Hurdles

Money brings its own walls. Mortgages exist, but banks often demand 30–40% upfront. That alone shuts out a lot of investors in property development. Even if you can manage the down payment, currency shifts may chip away at returns when you move money back home. Gains here do not always look like gains in pounds, euros, or rupees. And then there is paperwork. Endless documents. Some need notarization; some need stamps from embassies. Miss one step, and the deal slows down for weeks. Without local help, most investors spend more time fixing admin issues than buying property. Careful planning and having someone on the ground are what keeps the process moving.

The Psychological and Trust Deficit

The hardest part of investing abroad is not always paperwork or money. It is a worry. For someone sitting thousands of miles away, the fear of the unknown is powerful. Without boots on the ground, most people rely on online research, and the internet never tells the full story. Concerns about hidden charges, incomplete due diligence, or being pushed into high-pressure deals to create a real trust gap. What the investor needs is someone local, reliable, and ethical who can protect their interests every step of the way.

Deeper Commentary and Analysis

The problem is not that Dubai is unfriendly to outsiders. It is the imbalance of information. The headlines and statistics are glowing, but they do not give you the small details you need to make a safe decision. That is where a trusted partner steps in. The true value of a firm like PFOC is not just showing you options; it is giving you the right information and guiding you through secure processes. This need has only grown with recent policy shifts. The 2025 Golden Visa reforms are exciting, but they also make things more complex.

Thresholds have changed: AED 750,000 for a two-year visa, AED 2 million for the 10-year visa, and financing rules are different now too, with banks allowed to provide up to 50% funding if they issue a No Objection Certificate. For foreign property investors in Dubai, that means more opportunity, but also more confusion. And that is exactly why having a knowledgeable PFOC Dubai real estate agents team is so critical. They are not just brokers; they are the ones bridging the trust gap, keeping investors informed and protected in a market that moves fast.

The Definitive Bridge How PFOC Properties Earns Trust Here is the thing: PFOC Properties Dubai is not about closing deals. Anyone can push papers or show you listings. What sets them apart is their role as a true partner, stepping in when others step out. They cover the gaps that usually scare foreign buyers: the trust issues, the legal headaches, the visa confusion. Rather than just acting as an intermediary, they become the bridge that connects buyers with their ideal investment opportunities.

Strategic Advisory and Market Intelligence

Most people think of agents as salespeople. PFOC flips that idea. They start by asking what you want: steady rental income, long-term appreciation, or a UAE property investor visa. Then they dig into data and match those goals with real opportunities. Not just any developer, either. They focus on reputable developers, names with a proven track record, like Aldar Properties or Damac Properties. The point is simple: make sure every investor property decision is built on solid ground, not hype.

Legal and Transactional Facilitation

Buying can feel like a maze, especially when it comes to buying property in Dubai for foreign investors. PFOC takes that weight off. They check the property, the developer, and the contracts. They handle the Memorandum of Understanding, the NOC, and finally the title deed at DLD. Every step is ticked off, no shortcuts, no surprises. That way, investors do not wake up to hidden costs or missed deadlines.

Case Study 2: Golden Visa Achieved Through Strategic Property Purchase

A foreign investor wanted to invest in property for a 10-year UAE Golden Visa but was unsure about the AED 2 million cap and how financing works. PFOC got the purchase structured right, bank NOCs were coordinated, and the visa documents were handed (Source). The client gained a residence and an increasing value, a long-term investment.

Client Quote: “What was hard was suddenly easy overnight. They helped me all the way and facilitated my Golden Visa application process.”

Comprehensive Visa and Residency Support

For international buyers, the visa is a big piece of the puzzle. The property investor visa in the UAE is the ticket to staying long term, but the rules keep shifting. In 2025, the thresholds changed again: AED 750k for the two-year option, AED 2 million for the 10-year Golden Visa. Add new rules about mortgage financing, and it is easy to get lost. This is where PFOC steps in. They help gather every document, from deeds to bank letters, and guide clients through the latest requirements. For buyers of properties for investors, this means less paperwork stress and clarity about what you qualify for. Instead of fumbling through policies, you have a team making sure you do not miss a step.

Seamless Post-Purchase Lifecycle Management

For PFOC, the relationship does not stop once the title deed changes hands. That is usually where most firms step back, but this is where they lean in. For absentee landlords, that is important. Post-purchase, PFOC handles property management, dealing with tenants, maintenance, and even legal compliance. It is not just about renting collections. It is about turning the property into a passive, income-generating asset. That is what sets them apart from typical Dubai property brokers and why clients continue to trust PFOC Properties Dubai long after the sale.

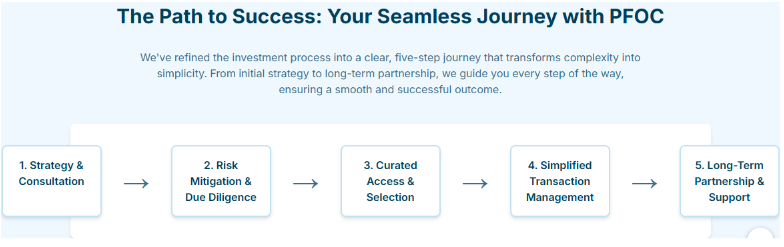

Deeper Commentary and Analysis

The real strength of PFOC’s model is how it covers the entire journey. Before purchasing, it is a strategy. During the transaction, there is due diligence and legal checks. Afterward, it is ongoing management and visa support. At no point is the investor left on their own. That kind of full-spectrum approach is the true meaning of “bridging the gap.” It is not a tagline; it is built into how they operate. Bigger agencies may have more testimonials, but the structure and depth of PFOC’s services speak louder. From the first consultation to long-term management, they treat Dubai real estate investment as a lifecycle, not a one-off deal. And for international buyers, that is where the value lies with a single partner for every stage. This is why so many trust Dubai real estate for PFOC by foreign investors.

| The Dubai Property Investor Visa Options (2025 Update) | Key Details |

|---|---|

| Visa Type | |

| 2-Year Residency Visa | |

| 10-Year Golden Visa | |

| The PFOC Properties Solution Matrix | |

| Investor Challenge | |

| Market Opaqueness | |

| Legal Complexity | |

| Financial Hurdles | |

| Visa Intricacies | |

| Long-Term Management | |

Case Study 3: Absentee Landlord Turns Property into Passive Income

One off-plan unit was sold to an expat investor who is concerned about tenant management, maintenance, and compliance with post-handover. PFOC remained involved in post-closing and delivered full-service property management, tenant relations coordination, and legal representation. Here, before the investment, the asset was an income-producing asset.

Client Quote: The support continued beyond the sale of the product. I get rental income without the hassle of paperwork.

How PFOC Properties Provides End-to-End Support for Foreign Investors

PFOC Properties Dubai has carved a role far bigger than that of a traditional broker. For foreign property investors in Dubai, the firm has built a system that covers the entire journey from initial research to long-term asset management. It is a shift from “here’s a listing” to “here’s a strategy,” and that is what makes them different.

Market Intelligence and Strategy

Most firms show properties. PFOC digs deeper. Their PFOC Dubai real estate agents start with the investor’s goals: do you want steady rental income, or are you chasing appreciation? Are you aiming for residency through a UAE property investor visa? Whatever the target, the advice is built around that. With access to market data and local knowledge, they point clients toward reputable developers’ names with the weight of an Aldar Properties investor or a Damac Properties investor or toward new communities set for growth. The idea is simple: turn decisions into strategy, not guesswork.

Legal and Transactional Guidance

For foreign investors buying property in Dubai, paperwork is often the scariest part. Contracts, NOCs, and DLD registration are a lot. PFOC steps in here, running checks on developers, making sure agreements are tight, and walking investors through each stage: MOU, NOC, final registration. Nothing left to chance, no room for surprises.

Visa and Residency Support

A major attraction is the property investor visa in the UAE. But the rules keep changing. Today, it is AED 750k for a two-year visa and AED 2 million for the 10-year Golden Visa. On top of that, new rules allow 50% mortgage financing if a bank issues an NOC. For many, this is where confusion can arise. PFOC’s team clears the fog, pulling together title deeds, passport copies, and bank letters to make the process smooth. For buyers of properties for investors, it is one less thing to stress about.

Beyond the Sale

The relationship does not stop after the handover. For absentee owners, PFOC provides full property management from tenant relations to maintenance to compliance. That means consistent passive income without the landlord being on-site. It is part of their bigger picture: seeing property investment in Dubai not as a single purchase but as a lifecycle

FAQs

Why do foreign property investors trust PFOC Properties in Dubai?

Because PFOC does not work like a typical broker. Foreign property investors in Dubai rely on them, as they cover the entire journey before, during, and after the purchase. That means strategy at the start, handling every legal step in the middle, and then long-term support like visas and property management. They know the rules, the market, and the policy updates. For investors, that mix translates into peace of mind.

How can PFOC Properties help foreign investors in Dubai’s real estate market?

The firm acts as an on-the-ground partner. Instead of buyers piecing things together online, PFOC simplifies Dubai real estate investment. They highlight the best opportunities, conduct due diligence to ensure clients do not fall into hidden-fee traps, and manage the transaction from the offer through to the DLD title deed. Also, they handle the UAE property investor visa process and provide property management, so the asset earns while the investor stays hands-off.

What makes Dubai a top destination for foreign property investors?

Dubai attracts international buyers for good reasons. High rental yields are often 7% or more, plus steady capital appreciation. Add in zero personal income tax, no capital gains on residential sales, and a transparent legal framework. Long-term residency through property adds another layer of security. It is the combination of lifestyle, tax benefits, and stability that keeps properties for investors in Dubai in such high demand.

Can PFOC Properties assist with obtaining a property visa in Dubai?

Yes. Navigating the property investor visa in the UAE can be tricky, especially with the new rules and thresholds. PFOC helps investors apply for both the 2-year visa (minimum AED 750k) and the 10-year Golden Visa (minimum AED 2m). They also handle the additional steps when mortgages are involved, such as securing NOCs from banks and compiling documents. This makes the process smoother for anyone investing through Dubai property investment consultants.

Can Foreigners Own Real Estate in Dubai Completely?

Yes. Foreigners can own 100% freehold property in specific areas, and the full right to sell, lease, or bequeath that land.

Does Dubai have property tax per annum?

No, Dubai does not levy an annual property tax, a capital gains tax, or a personal income tax on residential property investments.

Is Dubai real estate a secure investment for foreigners in the long run?

Investor culture, legislation and long-term government policy (such as Real Estate Strategy 2033 – the largest known Government initiative to date), strong demand for rentals also makes Dubai one of the most stable markets for foreign investment.

What are the key risks for non-resident property buyers in Dubai?

The most frequent risks associated with buying off-plan investment property abroad are: Picking the wrong ownership type, Off-plan delays, being buttonholed into a dubious legal agreement, Problems passing your investment on, and Inadequate local oversight. The pain and risks can be greatly reduced with a consultant you trust.

Can PFOC Properties assist after we buy?

Yes. PFOC offers post-purchase assistance, including property management, tenant relations, maintenance, and compliance, particularly valuable for out-of-country investors.

Must I be physically in Dubai to purchase property?

No. And with the right paperwork and a trusted local ally such as PFOC, foreign investors can complete many of those steps without setting foot in Brazil.

Conclusion:

In today’s global investment landscape, opportunity and risk always walk side by side. And yet, Dubai manages to stand out. The city offers high rental yields, strong capital growth, and clear, investor-friendly policies, making it a magnet for foreign property investors in Dubai seeking both safety and scale in their portfolios. But anyone who has invested abroad knows it is never simple. Legal details, financing rules, and the trust gap of managing things from a distance can make even the best market look daunting.

That is where the value of a trusted partner on the ground comes in. PFOC Properties Dubai has shaped itself into that partner. They do not just close deals; they walk with clients through every stage. Strategy before the purchase. Due diligence and contracts during the transaction. Property management and visa support afterward. It is a lifecycle approach designed to protect the investor at every step. The takeaway is simple: for the property investor, Dubai is not just another option; it is one of the safest bets for long-term wealth. And with the expertise of a real estate agency in Dubai guiding the process, what once seemed complex becomes clear, secure, and profitable.