Property Investment in UAE from Pakistan: Legal & Tax Insights

Property Investment in UAE From Pakistan: The Ultimate 2025 Legal & Tax Investor’s Guide

South Asian investors are flocking to the growing UAE real estate market, driven by a global perspective on wealth transformation. The global perspective on real estate. Fair Drive emerged as a realtor. For a Pakistani investor, a resident looking to protect their wealth, or an expatriate building their future home in the UAE, the housing market is a portal to portfolio diversification, smoothening out inflation shocks and greater mobility across the world. In the first six months of 2025, Pakistani nationals contributed towards the monumental success enjoyed by the UAE real estate market (especially Dubai).

They set new records, with total sales reaching approximately USD 117.43 billion in H1 2025, a significant increase over H1 2024 The post provides comprehensive, in-depth, research-based reviews of the legal, fiscal, and financial framework for investing in property in the United Arab Emirates (UAE) by Pakistani–UAE-based expat investors.

UAE Property Investment Introduction: Why the Corridor is Extending

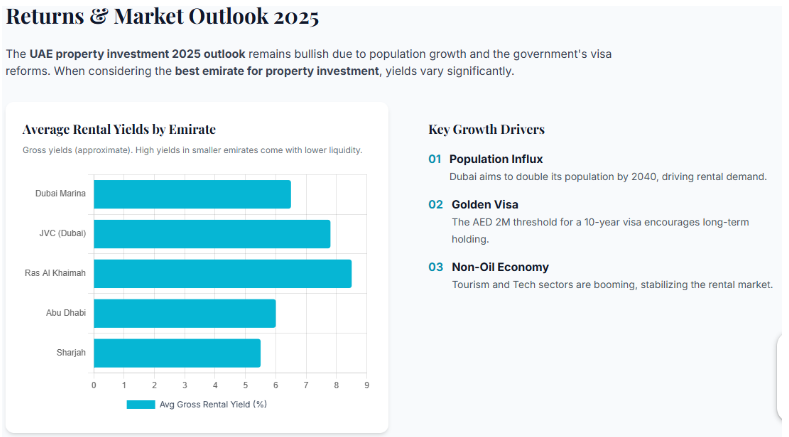

The rising interest in UAE property from Pakistan is not just a geographic phenomenon but a macroeconomic diversification strategy. With Pakistan suffering from the effects of inflation and currency fluctuations, a stable environment in the UAE, pegged to the US dollar, can offer an attractive proposition, with average rental yields reaching 9.4 per cent in select sub-markets.

Tax Breaks: The UAE Approach

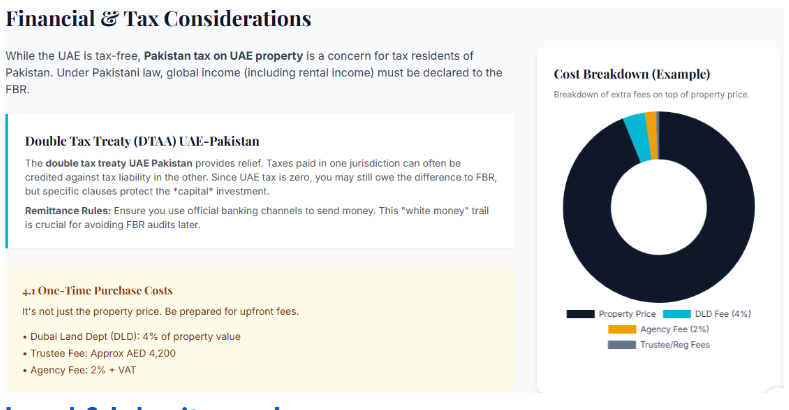

The UAE is known to be one of the world’s most property-owner-friendly, tax-efficient jurisdictions. As it stands, rental income is zero-rated for personal income tax (PIT), as are capital gains for individuals and inheritance. The sole one-time cost is the 4% Dubai Land Department (DLD) transfer fee, a figure typically offset by strong capital appreciation, estimated at 5–8% for 2025.

Market Stability + High (Rental) Yields

And in contrast to the sluggishness experienced by so many Western markets, UAE real estate investment in Pakistan offers a “Triple Alpha”: capital appreciation, superb rental yields, and currency stability. By 2025, the average rental yield in Dubai is 7.4 percent, far above the 2 to 3 percent we see in cities like London or New York.

Business Bay: Yield Arbitrage, a Case Study

A Karachi-based HNI (High Net Worth Individual) family sought to protect their wealth from a 30%-rupee devaluation. They worked with PFOC Properties to complete the purchase of three commercial units in Business Bay, Dubai. PFOC combined necessary market-timing information and identified a price-to-rent disconnect in Q4 2024, enabling the client to acquire ahead of forecasted supply implications in 2025. An 8.5% net cash yield was achieved for serene foreign currency revenues in an instant.

Client Quote: “PFOC’s views and timing in the market were invaluable to safeguard our value from currency risk. The advice took me from a precarious one-stop income to a secure portfolio. – Client, Karachi

Types of Property Ownership: Freehold vs Leasehold

Pakistani investors must understand the difference between these two types of ownership if they are to build wealth over time.

- Freehold: In a “Freehold Zone,” non-GCC nationals can own land and property indefinitely. It is, in fact, the ideal way to purchase an apartment in Pakistan for Dubai, as it offers the best liquidity and ensures clear succession rights for future generations

- Leasehold: An ownership with a limited duration, usually up to 99 years. It is less common among foreigners, and only in some old areas or industrial zones.

Regional Differences

Dubai continues to be the glamour stretch, but Abu Dhabi saw transaction volumes surge by 40% in H1 2025, with demand fueled by billion-dirham mega-projects on Yas Island and Saadiyat Island. Sharjah is also increasingly viewed as a more pragmatic option, with property prices averaging 30-40% lower than in Dubai, and it has been attracting mid-market investors looking for entry-level luxury.

Case Study: Regional Diversification

Sohail Alam, representing PFOC Properties, advised an institutional investor to look beyond luxury Dubai toward Sharjah, the ‘new kid on the block. By identifying developers offering high-quality projects at lower entry points, PFOC helped the investor capitalize on the 48% increase in Sharjah’s transaction values.” Using PFOC’s foresight of the 48% increase in transaction values in Sharjah, the investor purchased a block of studio flats. This netted a 9.1% gross yield, well in excess of the investor’s previous central Dubai holdings, illustrating regional market arbitrage at work.

Legal Formalities & Conditions for Pakistanis

Among the most widespread myths, he said, is that foreign investors need a residency visa to purchase property. This is false.

Can Pakistanis Invest?

If you are a Pakistani national, you can easily buy a Dubai apartment with your passport. You do not require a UAE residency visa or a local partner to buy in freehold areas. But your tax residence status in Pakistan will determine how you report and to whom, i.e., the Federal Board of Revenue (FBR).

Ownership Rules & Zones

The Pakistani investor focuses primarily on freehold zones, including Dubai Marina, Downtown Dubai, and Jumeirah Village Circle (JVC). In these areas, properties are 100% owned and registered with the DLD or its representative local Emirate land department.

Documentation Required

Several documents for a UAE property purchase are required to make a purchase:

- Original Passport and copies.

- Funds – evidence of funds/statements (usually for 3 to 6 months) from the bank.

- SPA / Form F [in the case of a secondary market]

- Authenticated POA if the sale is being processed remotely.

Process & Timeline

How long does it take to buy a property in the UAE? The UAE property buying process for ready properties typically takes 2-4 weeks.

- Research & Agent Selection: Choose a RERA-certified broker such as PFOC Properties.

- MOU/SPA: Execution of the master agreement and making a deposit payment (usually 10%).

- No Objection Certificate (NOC): Provided by the developer, acknowledge that all service charges have been paid.

- Transferring: Last Register at the Department of Land; get the Title Deed.

A Case Study: The Remote Transaction

A Karachi doctor was looking to invest without getting on a plane. PFOC Properties handled the end-to-end process, from remote property selection through 3D virtual tours to the digital signing of the SPA and the payment of the 10% down payment via international wire transfer. PFOC even took care of the utility connections (DEWA and district cooling providers like Empower), thus delivering a “ready-to-rent” asset within 30 days for our client.

Financial & Tax Aspects (DTAA and SBP Mechanism)

The success of UAE real estate as an investment vehicle is closely tied to an investor’s tax status in Pakistan. Pakistan is a resident-based territory with worldwide income tax liability under the general rule of the Income Tax Ordinance, 2001.

UAE Tax Regime

For personal property income, the UAE provides a zero-tax regime. But the 4% transfer fee and the annual service charge should be considered by all investors. Service charges range from 12 to 25 AED per square foot, depending on the building’s facilities.

Potential Pakistan Tax Implications (Sec7E & Wealth Sta)

The Finance Acts 2024 and 2025 included multiple provisions that impose additional costs on holding foreign wealth. UAE properties of resident individuals have to be reported in the Wealth Statement (Form 116).

- Rental Income: Foreign rental income is added to the investor’s total income and then subjected to individual slab rates, Status: Correct. The Finance Act 2024-25 indeed set the maximum tax slab for non-salaried individuals at 45% for income exceeding PKR 5.6 million annually.

- Capital Gains Tax (CGT): A flat CGT rate of 15% for filers, irrespective of holding period, for properties purchased after 1st July 2024.

- Section 7E (Deemed Rental Income): While Section 7E historically applied a 1% effective tax on the value of properties, there have been significant legal challenges and legislative discussions in 2025 regarding its application to foreign assets. Investors should consult with a tax professional, as recent reforms aim to streamline property transactions for overseas Pakistanis, potentially exempting non-residents from certain advance taxes (Sections 236C/K) regardless of their filer status

Double Tax Treaty UAE-Pakistan

A double tax treaty between the UAE and Pakistan is intended to prevent income from being taxed twice in both countries. Paragraph 6 allows the income from real estate taxes to be covered by the country where the property is located (UAE). Since individuals are not taxed in the UAE, Pakistan has the authority to tax its residents on income (and give them credits for any future taxes they may pay to the UAE).

Remittance & Exchange Control Rules (SBP)

The State Bank of Pakistan (SBP) imposes strict remittance rules for payments to property in the UAE. Under the SBP’s 2025 Foreign Exchange Manual, resident individuals are allowed to remit up to USD 25,000 per calendar year specifically for listed securities (stocks). Direct investment in foreign immovable property is generally not permitted under this automatic limit and requires explicit, case-by-case approval from the SBP or the use of legally held foreign currency accounts (like the RDA for eligible non-residents). Direct investments in real estate may require explicit SBP permission, or they can be made through retention accounts (legal foreign exchange accounts) that are repatriable, such as Roshan Digital Accounts.

Case Study: Getting Through FBR Audit

Interpret Figure 1 with the help of discussions at different level chambers (Currently You are Here). Let us try to get through a sample case study. You may need to visit each level chamber in this way. LAHORE:An active filer from Lahore was red-flagged by the FBR for ‘unexplained foreign assets’ after purchasing an apartment in Jumeirah Village Circle. PFOC Properties supplies a complete Financial Audit Pack comprising the DLD-registered title deed, proof of funds via an RDA, and validation of the rent-to-capital-gain conversion. This evidence enabled the client’s tax adviser to win the argument that the investment was completely legitimate, when otherwise he would have faced a 45% penalty.

Client Quote: “PFOC Properties has made me completely understand the Dubai market. They did not sell me a property but offered me a 10-year residency plan.” Their aid in getting a mortgage for me as a non-resident was priceless: they negotiated a special interest rate I would otherwise not get on my own.”

Dr Ahmed S., Specialist Physician (Lahore)

Financing Property Investment

When getting a mortgage in the UAE as a Pakistani, there are two parameters you need to consider to avail the best UAE mortgage for Pakistani residents.

Mortgage Options for Non-Residents

UAE residents can obtain an LTV of up to 80%, whereas expats (including Pakistanis) can get an LTV of 50-65%.

- Minimum Down Payment: Usually, 35% to 50% for non-residents.

- Interest Rates: 5.25-6.5% for non-residents in 2025 / max rate: 883,000 people’s lakh is the maximum limit, and for others, as per eligibility. Less than Nothing: Power of attorney charges, only if required. Stamping Error Rs.

- Banks FAB, Emirates NBD, and ADCB have introduced products specifically for the Pakistani community.

Halal Investment and Islamic Finance

For those looking for a halal investment in UAE property or Pakistan, Islamic mortgages (Murabaha or Ijara) are easy to obtain. These models do not involve Riba and are either profit-sharing or lease-to-own models.

Golden Visa through Property

That, of course, is the UAE Golden Visa, which is a 10-year renewal of a residency visa for property investors, pegged at 2 million AED.

- Threshold: 2 million dirhams ($545,000 at current exchange rates) in one or more properties.

- Terms and conditions: The property can be ready or off-plan, and “As of 2025, the UAE has significantly lowered the cash-entry barrier. The AED 1 million down payment requirement has been eliminated. You can now qualify for a 10-year Golden Visa with a property valued at AED 2 million or more, even if it is mortgaged or off-plan, provided the property value is confirmed by a Dubai Land Department (DLD) valuation certificate

Case: Multi-Unit Financing Strategy Example

A Karachi-based professional used PFOC Properties to purchase two units in Dubai Hills Estate. PFOC arranged a “Hybrid Financing” solution in which the client made a 50% cash payment (to fulfil the AED 2M equity requirement for the visa) and took out a non-resident mortgage. The client was able to maximise his liquid capital and qualify for his family for the Golden Visa in a very short time.

Returns & Post-Purchase Management

The logic behind making that investment has everything to do with math.

Rental Income Potential

The net rental yields are after service charges:

By 2025, sectors like Dubai Marina and Business Bay of Dubai are still providing net yields as high as 6 – 8%, which is higher than the mere 1-2% yield calculation that is seen in Pakistan’s luxury segments, accounting for inflation.

Capital Appreciation

Market analysts predict property prices will rise by 5-8 per cent in 2025, with hotspots such as Palm Jumeirah experiencing spikes of up to 10%.

Case Study: Branded Residences

An investor with PFOC Properties is involved in the pre-launch of a branded residence in Downtown Dubai. PFOC’s own technical analysis concluded that on resale, these branded properties sell at a 20-30% premium. Having walked in at the “Developer Price,” that customer still realised an Interim Capital gain (unrealised) of 15%, even before construction reached 20%.

Risks and Mitigation Strategies

If the market is strong, customers must ensure their UAE property investment risks in Pakistan by conducting due diligence.

Off-Plan Property Risks

The main danger is construction delays. To mitigate this, investors should:

- Check the developer’s history on the Dubai REST app.

- Check for a RERA-certified Escrow Account of the project.

Ensure that the project status is set to “Active” and that the escrow number matches your register.

Legal & Inheritance Law

Property Inheritance Law in the UAE and Pakistan Revisions. In the UAE, Pakistan’s property inheritance law has undergone a significant transformation. In accordance with Federal Decree-Law No. 41 of 2024, non-Muslims may use the laws of their country of domicile by taking out a Will. Muslims who wish to specify the disposition of their assets and to appoint guardians (if applicable) – to avoid the automatic application of Sharia law, which freezes the testator’s assets – are also advised to register a Will with DAJD or DIFC.

Case Study: Risk Mitigation in the Failed Project

This driver came to PFOC Properties after he had his eye on a site in the fringe district, which went cold. PFOC conducted an audit of the project and found that the developer had not complied with RERA deadlines. PFOC helped move the client’s remaining balance to a Tier-1 project with a more stable delivery schedule, allowing the team to preserve capital by avoiding long-term liquidation.

Client Quote: “I didn’t want to be waiting around for my funds if the project never went ahead. PFOC’s proactive approach has enabled me to move into a safer, more secure investment promptly. I value their knowledge and help.” Client, Dubai

Pakistani Investors’ To-Do List: The Battle Plan for Acquisition

- Set Goals: Do you want to make a quick return on capital or hold for rental cash flow?

- Check for Freehold Eligibility: Confirm whether the project is located in a 100% foreign-ownership area.

- Financial planning: Budget for the 4% DLD fee, the 2% agency commission, and service charges.

- Documentation: Make sure you have your passport, proof of funds, and POA (if remote) ready.

- Audit History: Record all remittances from Pakistan for FBR reporting purposes.

- Post-Purchase Registration: Register your property with DEWA and arrange a property management contract if you are a non-resident.

How PFOC Properties Can Help

In a market characterised by heavy trading activity and strict rules, PFOC Properties serves as a dedicated trust for Pakistan’s local investment community. Led by Aurangzeb Chawla, the company is centred on data-driven investment rather than speculative buying.

- Market Arbitrage: Opportunistically purchasing undervalued units in up-and-coming areas such as Sharjah or Abu Dhabi.

- Compliance Assistance: Help ensure purchases comply with FBR and SBP reporting requirements.

- Remote Management: A complete one-stop shop for Pakistanis abroad – From purchasing the property to finding tenants.

- Golden Visa Facilitation: Specialist liaison with the GDRFA for 10-year residency applications.

FAQs

Is it possible for Pakistanis to buy property in the UAE legally?

Yes. Under UAE and Pakistani law, there is no restriction on foreign ownership of property. But these assets should be declared with the FBR, along with complying with the SBP’s outward remittance instructions for Pakistanis.

Are Pakistani residents required to pay tax on rental income from UAE property?

Yes. Personal Taxation: Non-resident Pakistanis are not taxed on income outside Pakistan. UAE rental income must be declared in your FBR return and is subject to flat slab rates of tax.

What is the tax treatment of capital gains on the sale of UAE property in Pakistan?

For properties acquired after July 1, 2024, a flat rate of 15% applies to capital gains for filers. Those who do not file could face rates as high as 45%

Can I avail of treaty benefits under the UAE-Pakistan double tax treaty for my overall tax reduction?

Yes. It avoids double taxation of the same income. Although the UAE does not tax individuals, if it did, you would be able to claim a credit in Pakistan for the tax paid in the UAE.

What is the floor limit for Pakistanis?

The law requires no minimum purchase. To qualify for a residency visa, you need to have purchased a property worth at least AED 750,000 (for a two-year visa) or AED 2 million (Golden Visa – 10-year).

What papers do I need in Pakistan and the UAE?

You require your Passport, Bank Statements (3 – 6 months), and proof of income (Salary Slips or tax returns). If purchasing in absentia, an attested POA is applicable.

How can I transfer money from Pakistan to buy property as per SBP guidelines?

Up to $25,000 can be sent each year for listed securities. Investors use Roshan Digital Accounts (RDA) to make high-ticket real estate payments or to apply directly for SBP’s subject approval for outward investment.

Is there any withholding tax, zakat, or FBR reporting obligations?

There is no personal withholding tax in the UAE. Zakat is also payable on investment properties (market value) or on rental income (not used for daily expenses) if held for a period of one lunar year. Rich debuts foreign ‘wealth statement.’ So, in Pakistan, you have to declare your assets in your Wealth Statement.

Is off-plan property a secure investment for Pakistanis?

Safe in terms of a registered project with RERA and money in the escrow account. Please check the project on the Dubai REST app before paying.

Can I invest and qualify for a UAE residence visa?

Yes. If you invest AED 2 million or more in a property, you will be eligible for a 10-year Golden Visa for yourself and your family.

Can we declare the rental while we file returns in Iris for Pakistan?

It should be reported in the “Foreign Income” section. It had prepared an extraordinary “Electronic Foreign Income and Assets Declaration” for 2025.

What are the inheritance implications for a Pakistani family?

If a person does not leave behind a Will, then Sharia takes effect. We strongly advise you to have a DIFC or ADJD Will registered so that your assets are distributed according to your personal intentions.

How do I ascertain if a developer in the UAE is indeed registered?

The Dubai REST app is available on the DLD website. Enter the project number to confirm that it is “Active” and has a confirmed Escrow account.

What currency and remittance risks do I need to worry about?

While holding both pairs can act as a natural hedge by keeping them in AED (pegged against USD). PRO TIP: Buying both is not about buying or selling; it is more about holding. Incomplete documentation can delay remittances.

Is it better to own a property in my name personally or a company’s name?

For most individual investors, personal names are easier and cheaper. Owning through a company (e.g., a JAFZA offshore company) may offer greater privacy and a more seamless inheritance transfer, but it entails higher setup and annual fees.

Conclusion & Actionable Advice

The picture for UAE property investment in 2025 looks very positive. Strategic residence programs, along with a high-yield environment, have made Dubai the first choice for Pakistanis seeking capital preservation, and its neighbourhoods, the Emirates, are among the most sought-after. The “UK Tax Advisor” view is that investment needs to be met with compliance. A “high-transparency” regime has been promulgated in Pakistan, vide the Finance Act 2024. The successful investors will be those who focus on their Tier-1 quality developers, prefer legal certainty through the application of Wills, and maintain financial transparency with the FBR.

Final Technical Analysis: The 2025 Market Turning Point

With some 240,000 new units expected to come online by 2027, we see a shift from a seller’s market to a balanced market. This offers a tactical opportunity in Q4 2025 for Pakistani buyers to secure the best following assets ahead of the new equilibrium cycle.

As an overseas Pakistani, I was concerned about my family’s rights post-inheritance law changes. PFOC Properties guided us through the process of registering our DIFC Will and helped us build our investment portfolio. Their professionalism is unmatched.”

Mariam Z., Senior Finance Manager (Dubai Expat)

We established our corporate headquarters in Dubai through the PFOC. Successfully managed the SBP compliance for our first transfer and also secured us a prime office space in Business Bay, which has already gained 12% value.” For this concluding analysis, a family office wanted to identify and audit its existing UAE assets. PFOC Properties found that about 30% of its portfolio was in high-risk edge locations. “The fund structured a tactical shift into ‘Branded Residences’ in Palm Jebel Ali through PFOC. This raised the potential capital gain by 15% and ensured that the family remained eligible for more than a single Golden Visa application.”