Dubai vs. Pakistan: Which Real Estate Market Gives Better Returns?

Introduction:

In 2025, the global real estate landscape will have changed dramatically for Pakistani citizens. Land has traditionally been the ultimate repository for wealth in Pakistan. However, shifting tectonic plate movements in global finance and local tax reforms, as well as the rise of Dubai, a highly regulated alternative with high yields, have forced a review of traditional assumptions. This report is a comprehensive, research-based examination of the Dubai and Pakistan property markets, with a focus on rental yields and capital appreciation. It also examines regulatory protections and the evolving tax climate of 2026.

Market Overviews

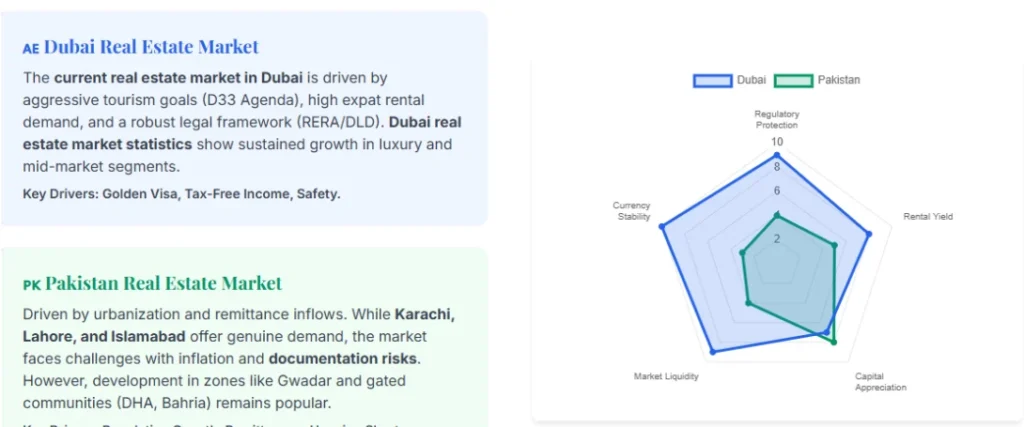

Dubai Real Estate Market Overview

Dubai’s real estate market is currently in a mature phase, after a rapid recovery from the pandemic. The Dubai Land Department’s (DLD) data for the first six months of 2025 shows an extraordinary performance. Transaction values exceeded AED 431bn, a 25% rise over H1 2024.

RERA (Real Estate Regulatory Agency) mandates Dubai escrow accounts to protect buyer funds. Each off-plan project must have a specific escrow account. Ensure funds are only released after the DLD has verified construction milestones.

Pakistan Real Estate Market Overview

To reduce the risk of illegal occupation, or “qabza”, the government policy prioritizes the acquisition of “on the ground” developed assets.

Case study: Portfolio Rebalancing

An expatriate Pakistani held “files” of several properties in a Lahore-based society that was in the process of development, but faced a Pakistan property risk when the project stagnated. PFOC Properties conducted a Dubai market trend analysis and recommended a pivot. The client was able to secure a 7.1% net return in stable currency by liquidating his files and investing in a studio apartment in Jumeirah Village Circle.

Client Quote:

“PFOC provided us with a level of clarity that we could not find anywhere else.”

Their ability to bridge a gap between the local Pakistani context and the international standards for Dubai real estate played a key role in our decision-making process. Now we have a portfolio that truly reflects our financial goals for the long term.

” Alice M.

Returns and Yield Comparisons

Rent Yields

Dubai rental yields vs Pakistan show a clear divergence by 2025. Dubai’s rental yields range between 6% to 9%, with some affordable communities, like International City and Dubai Investment Park (DIP), reaching over 10%. The average return on Pakistani property investments is 6.24% to 6.53%. Karachi has an average of 6.21%, and Islamabad, 6.75%.

| Market | Gross Yield (Avg) | High-Yield Precincts |

|---|---|---|

| Dubai | 7.3% (Apartments) | International City (10%+), JVC (7.11%) |

| Pakistan | 6.24% (Apartments) | Islamabad (7.01%), Bahria Town Rawalpindi (10% for 2BR) |

Capital Growth & ROI

Dubai’s growth is realized in AED (pegged to the USD), providing a hedge against PKR devaluation.

Case study: The Yield Maximizer

An investor from Karachi wanted to increase his passive income. PFOC Properties found a high-yield opportunity in Dubai South that offered a 7.85% return. The investment generates income tax-free, which can be easily sent to Pakistan.

Detailed Comparative Analysis

Market liquidity & exit options

Dubai’s property resale statistics reveal a very liquid market. Ready properties in the prime hubs sell within 30-60 days. In Pakistan, the liquidity of plots in DHA Karachi or Lahore is wildly variable. While “file” trading remains active, it has been slowed down due to Pakistan’s capital gains taxes and property documentation requirements.

Risk & Regulatory Landscape

Dubai provides a “sanctuary for stability” with the Dubai due diligence checklist supplied by RERA. Dubai’s escrow rules ensure that in the event of a cancellation, the funds will be returned to the buyers on a pro-rata basis from the escrow. Pakistan has property title issues, but provincial governments are digitizing their land records to reduce these risks.

Taxes & Costs

In Pakistan, non-filers are subject to punitive withholding tax (Section 236) of up to 18% for high-value property.

Case Study: Tax Structuring

The client wanted to move money to the UAE and sell a large plot of commercial property in Islamabad. PFOC Properties conducted a market comparison of Dubai and provided advice on tax implications. PFOC Properties saved the client millions of dollars in withholding tax by ensuring that the client was an “active filer” within Pakistan before facilitating the entry into the Dubai real estate market.

Buyer Profiles & Suitability

Foreign Investors / Pakistani Nationals

The property requirements for Pakistanis are one of the main reasons they choose to live in the UAE. The investment of AED 2,000,000 grants 10 years of residency. This allows investors to sponsor their family and live/work without a local sponsor.

Local Pakistan Property Investors

A Pakistan property title check is a must for those who are staying in the country. To ensure security and utility, investors should concentrate on “on the ground” assets within gated communities.

Case Study: The Residency Route

A Lahore family wanted to move to the UAE for their children’s educational needs. PFOC Properties found a property at Dubai Hills Estate which met the AED2M threshold. They took care of the DLD registration as well as the Golden Visa application, which was approved in three weeks.

Submarket & Segment insights

Dubai Market Segments: Off-Plan vs Ready ROI

The debate between off-plan and ready ROI is important. In 2025, off-plan properties dominated the market with 60-70%. They offered capital gains between 15-25% before completion. However, ready properties provide an immediate cash flow and lower delivery risk.

Pakistan Market Segments

Lahore vs Dubai Property Trends show that Lahore’s Ring Road Corridor is a hotspot for growth, similar to Dubai’s peripheral expansion to Dubai South.

Case study: The Submarket Switch

Investors were unsure whether to buy a villa or an apartment in Business Bay. PFOC Properties presented a report on the current Dubai real estate market, showing that Business Bay apartment rentals had a 93% occupancy rate.

Client Quote: PFOC Properties did more than they had to do to secure our home at a great price. Their services are highly recommended to anyone who is looking for expertise and honesty in a rapidly moving market.

David L.

Common Questions and Misconceptions

Myth: Low-quality buildings in “hype”-only locations can offer high yields, but they suffer high maintenance costs and low capital gains.

Myth: Only residents of Dubai can obtain up to 50% LTV in Dubai.

Myth: In Pakistan, if a title is “registered,” it’s safe.

However, you must check the “Mother Deed, which traces the ownership history.

Dubai Property Checklist

Verify the project on the Dubai REST app.

Ensure 4% DLD fee and 2% agent commission are budgeted.

Obtain a Certificate of No Objection (NOC) for the developer.

Checklist for Buying Property in Pakistan

- Check FBR Active Taxpayer List (ATL) status.

- Verify the society’s NOC with the relevant authority (LDA/CDA/DHA). (Removed technical artifacts “HTML4_

- Trace “Mother Deed” and obtain a Non-Encumbrance Certificate.

Case study: The Diligence Guard

A client was on the verge of purchasing a plot from a society that had not been approved. The legal team at PFOC Properties identified that the plot was not approved, saving the client PKR20 million.

Client Quote:

I am delighted with the portfolio of properties PFOC Properties has secured for me. They provide the end-to-end assistance that foreign investors need.

Emily P.

What PFOC Properties Can Do

PFOC Properties is a strategic link between Pakistani investors and the Dubai Real Estate Ecosystem. We combine on-the-ground market intelligence with structured risk management. Our support extends beyond brokerage to investment advice and lifecycle asset management.

Market Intelligence & Deal Sourcing

- Real-time Dubai real estate statistics, including transaction volumes and absorption rates. Rental yield benchmarks are also available, as well as historical capital growth.

- Comparison of Dubai property returns with Pakistan property returns, highlighting currency risk, yield compression and exit liquidity.

- Early developer access led to off plan launches and private inventory.

- The selection of projects is based on ratios between price and rent, timelines for handover, and future supply lines.

Legal & Regulatory Facilitation

- The Dubai Land Department regulations are fully navigable, including Oqood registration and title deed issuance.

- Verification of the developer’s track record, escrow security, and risk mitigation at handover.

- Due diligence assistance on the Pakistani side, including mother-deed verification and chain of ownership checks.

- If applicable, structured guidance on eligibility for residency via property investment.

Capital Efficiency & Tax Structuring

- Advice on how to optimize exposure under Pakistan Property Tax Laws 2026, including declared value, withholding implications and timing of capital gains.

- Structure Dubai investments so that you can benefit from the UAE tax-free rental income environment and ensure compliance with remittances and reporting.

- Planning currency diversity and protecting capital against PKR depreciation by using AED-denominated investments for asset holding structures and inheritance planning for long-term wealth protection.

End-to-End Investment Management

- Support for the entire execution process, from unit booking and selection to SPA signature and DLD registration.

- After-handover Services including tenant placement, leasing strategy and rental yield optimization.

- The ongoing management includes maintenance oversight, monitoring of service charges, and annual ROI tracking.

- Planning your exit: Determine when to sell on-market (When you want access to the client base) based on demand-supply, market cycles, and other factors.

Investor-Centric Advisory Model

- Transparent fee structures without conflicting inventory.

- Relationship Managers are appointed for Pakistani investors. This helps to ensure a smooth connection between jurisdictions.

- You should review it regularly to make sure that the fund is up to date with the market and your investors’ needs.

FAQs

Dubai or Pakistan: Which market offers a higher rental yield?

The high-quality residential developments and strong rental demand are driving factors.

Which is the best market for cash reward, Dubai or Pakistan?

The AED is pegged to the USD. This provides a natural currency hedge for real returns and makes Dubai an even more attractive investment proposition due to the international investors not having any currency risk. Due to its peg with the USD, Pakistan’s nominal price growth may be in the range of 10-15% in certain urban areas.

How does Dubai net return look like after DLD fees, agent fees and service charges?

One should take into consideration all the expenses at the time of estimating Dubai property investments. This involves transactions and operational charges.

How much is the net return in Pakistan after tax, maintenance, and society fees?

Provincial property taxes, charges by societies, utility costs, maintenance and repairs that are unexpected can all reduce profitability.

Which property is more liquid, Dubai or Pakistan, for sale?

Dubai has a much more liquid real estate market than Pakistan; the property market in Dubai benefits from a high level of demand, transparency, and investor participation. Professional broker networks and developer resale program listings are used to facilitate the sale process. This allows properties to be moved quickly, often within a matter of weeks or months. Pricing is more transparent and helps investors determine fair value.

Dubai vs Pakistan - which market is less risky for UAE investors?

UAE Cross-Border Investment. We are trading in a world that is wider than our country, so the value of our money has become more important when we invest overseas. Currency risk is almost non-existent in Dubai as the AED is pegged to the USD. This enables investors to schedule their returns and investments in a way that is not impacted by adverse fluctuations in foreign exchange rates.

How much do you buy a house for in Dubai?

There are many costs that are not obvious when buying a property besides the price in Dubai. The biggest is the Dubai Land Department registration fee. This costs 4% of the property value and can be split between the buyer and seller, but it is usually paid by the buyer. Other costs include agent fees, which typically amount to 2% of the purchase price, and annual service charges, which vary between AED12 and AED30 per square foot, depending on amenities and location.

What are the hidden risks of buying property in Pakistan?

Pakistan’s property market has several hidden risks that can have a significant impact on investment outcomes. The most notable is “qabza,” an illegal occupation. A property can be encroached despite looking legitimate and requiring legal intervention to regain ownership. In unregulated societies, the “Mother Deed” may not accurately reflect the previous owner’s history. Other concerns include fraudulent or incomplete titles in an unregulated society.

Ready vs off-plan property in Dubai: Which offers better returns and exit options?

Opting for off-plan or ready-to-move-in properties in Dubai depends on your investment objectives and risk appetite. Off-plan units can create superior capital gains up to 15-25 percent as the purchasers have the opportunity to buy for less before handover, and value appreciation is possible before the project’s delivery. They are also drawing investors who seek long-term appreciation, diversification of their portfolios, and property-appreciation potential.

What are the top-yielding neighborhoods for UAE-based investors across Dubai?

In some neighborhoods of Dubai, the rental yield is higher than in other areas, particularly for property investors based in the UAE. International City and Dubai Investment Park (DIP) are among the best-performing areas. Hey often exceeds 8% gross rental returns. The communities have affordable entry points and strong tenant demand.

Which Pakistani cities/areas offer the highest rental yield to overseas buyers?

Rents in Pakistan vary greatly depending on the region. For example, some parts of Karachi and Islamabad have yields as high as 8.68%. This is due to the steady demand for rental units and high occupancy.

What documentation do I require for Dubai property due diligence documents?

To ensure investment security and legal ownership, it is important to gather and verify specific documents. In the case of off-plan properties, the Oqood Registration Certificate replaces the Title Deed. It verifies that the developer registered the unit legally in the Dubai Land Department’s (DLD) escrow. An escrow account verified by the DLD ensures that all payments will be protected.

How do I verify the property title in Pakistan before paying?

Verifying the legal title of a property is important to avoid any disputes or fraudulent transactions. The “Mother Deed” is the first step, which validates the transfer and traces the ownership history. Investors can also get a No Encumbrance Certificate from the land authority to ensure there are no outstanding loans, mortgages or legal disputes.

Does the UAE Golden Visa threshold impact ROI decisions?

The UAE Golden Visa has a minimum investment threshold of AED2 million. This influences investor behavior as well as ROI decisions. High-value investments are usually premium properties that are ready to rent in strategic locations. These properties offer greater stability and less maintenance risk compared to properties at lower costs. Golden Visa properties tend to be located in professionally managed developments, where rental income is predictable.

Which is the best property mix between Dubai and Pakistan for risk-adjusted return?

A balanced strategy for cross-border investment can help manage risk and maximize return. Experts recommend allocating 70/30 of the portfolio between Dubai properties for their high rental yields, stability in currency, and liquidity. The remaining 30 percent is allocated to prime Pakistani land or residential units to ensure long-term growth. Dubai property, especially located in high-demand locations, provides predictable income and low operational risks, as well as exposure to the stable AED market.

Conclusion & Investment Guidance

Data for 2025-2026 shows that, while Pakistan has an emotional and demographic pull, Dubai offers the financial rigor required to preserve modern wealth. The strategy for the Pakistani investor should be “Income from Dubai, Land in Pakistan.” PFOC Properties can help investors navigate the complexities involved in UAE-Pakistan remittances and build a global portfolio that is transparent and has a high return on investment.