How Dubai’s Property Market Is Evolving Post-COVID: Key Insights for Investors

Strategic analysis and 2026 outlook for international investors

Dubai’s real estate maturation process, going from regional hub to one of the world’s most prominent wealth hubs, has been fast-tracked in the aftermath of the global pandemic. The market over the next five years is going to demonstrate a depth of maturity that has been wholly absent in previous speculative periods, typified by institutional-grade transparency, authentic end-user demand, and long-term capital preservation. As the emirate looks to 2026, the realty sector matures into a ‘model-playing-field human resource-pool’ driven strategic norm, and altogether this new phase is dovetailed by a large-scale population inflow rate, world-renowned infrastructure projects such as the Dubai Metro Blue Line and a regime comprising legislation and best corporate policy norms.

Dubai property 2020 vs 2025: a comparative snapshot of market strength and weakness

The strength of the Dubai real estate market can be seen in the distance between pandemic lows of 2020 and record highs of 2025. Property values also faced a 7.9% contraction in global prices, as the world’s mobility ground to a halt at the beginning of the pandemic. But with the proactive crisis management by the Government of the UAE and a successful hosting of Expo 2020, it was foreseen that this crisis would act as a catalyst for continuing economic recovery, which, now five years consecutively, has led to ongoing quarterly growth.

Transaction values had increased over 70% from 2020 to 2021 by themselves, marking the beginning of a multi-year bull run. This expansion was not just a recovery, but the beginning of a new era in demographic and economic market drivers. “With the recent addition of long-term residency schemes, such as the 10-year Golden Visa, in place, the emirate became not only a transient location but also a permanent home for high-net-worth individuals (HNWIs) and skilled professionals. The market peaked in 2025 with an annual sales volume of AED 917 billion and total transactions equal to 270,000.

| Market Indicator | 2020 Performance | 2025 Performance | Growth / Change |

|---|---|---|---|

| Total Sales Value | ~AED 72 billion | AED 917 billion | +1,173% |

| Total Transaction Volume | ~31,616 units | 270,000 units | +754% |

| Off-Plan Market Share | ~55% | 70% | +15% (Structural shift) |

| Luxury Deals (>$10M) | Minimal | 435 units (2024 record) | Exponential increase |

| Resident Population | ~3.4 million | ~4.0 million | +17.6% |

| Average Rental Yield | 5% – 7% | 6% – 9% | Upward compression |

The buyer pool has been diverse in the post-COVID days as well. In 2025, women investors were more influential with investments worth AED154 billion through 76,700 transactions, recording a growth of 31% in value. This inclusiveness is reflected through the emergence of the “resident investor” foreigners who used to rent but now prefer to buy, encouraged by surging rents and easy access to cheap debt.

Compare the best post-COVID community in Dubai and its real estate prices and micro-market performance.

The recovery has been uneven throughout the city, with some neighborhoods blossoming as high-yield hubs or luxury havens. Prices have continued increasing steadily in 2024 and mid-2025, at an average of around AED 1,537 per post across the mainstream market and AED 3,767 per post across the top ten prime areas.

Prime and luxury district analysis

Palm Jumeirah and Downtown Dubai are enjoying substantial premiums in the luxury market. Apartment values in Palm Jumeirah were up 31% annually by the end of 2025, according to data from the report, which put prices at an average AED 2,773 per square foot. In the same way, Downtown Dubai has witnessed a 1-bedroom apartment’s average sales price spike up to AED 2.46 million, and AED 8.00 million for 3-bed flats. These regions have “scarcity value”; there is very little undeveloped land left for expansion in already developed prime areas.

Emerging high-yield communities

As an investor, if you are focusing primarily on Return on Investment (ROI), then mid-level communities such as JVC and Town Square have performed really well. JVC had the best ROI for middle villas at 7.24%, and Town Square was first in the mid-apartment bracket with an ROI of 7.72%. New areas such as Dubai Creek Harbour and Meydan City are also proving popular because of infrastructure improvements. Average prices for an apartment in Dubai Marina have been AED 2,190 per square foot after a slight rise that reflects the ongoing demand from professionals as well as visitors.

| Community | Avg Price / sq.ft (2025) | Avg 1-BR Price | Avg ROI |

|---|---|---|---|

| Dubai Marina | AED 2,190 | AED 1.75 million | 5.73% |

| Downtown Dubai | AED 3,247 | AED 2.46 million | 5.56% |

| Dubai Creek Harbour | AED 2,446 | AED 1.87 million | 6.15% |

| JVC | AED 1,200 – 1,400 | AED 850k – 1.1M | 7.87% |

| DAMAC Lagoons | AED 1,186 (Villas) | N/A | 10.46% |

| Dubai Hills Estate | AED 2,000+ | AED 1.6 million | 6.82% |

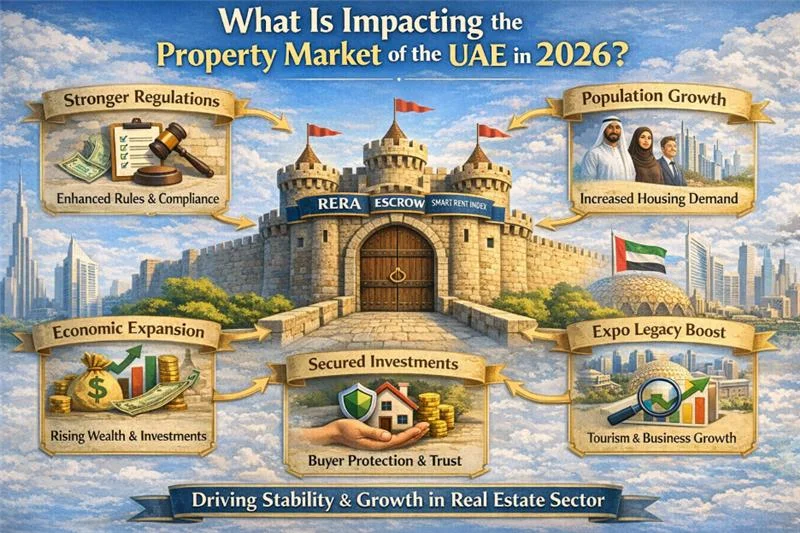

What Is Impacting the Property Market of the UAE in 2026:

Regional and global trends impact the growth pattern of the UAE real estate market. Market sentiment remains underpinned by an increase in the UAE’s GDP growth forecast to 5.1% in 2025 and 5.3% in 2026 by Oxford Economics.

Infrastructure and connectivity projects

The extension of the Dubai Mall and the launch of the Dubai Metro Blue Line have directly influenced property prices in fringe districts. In addition, connectivity remains among the strongest contributors to appreciation (with sites located near business hubs or metro lines). Moreover, the immense road development projects, such as Al Shindagha Corridor and Ras Al Khor, have increased accessibility and interest in locations such as Dubai Creek Harbour, where infrastructure is now catching up with residential completion.

The residency-investment nexus

The fact that residency is no longer tied to employment through the Golden Visa program has effectively transformed the logic of investment in Dubai. By spending at least AED 2 million in property, individuals are issued a 10-year renewable residency visa that is driven by long-term capital commitment rather than short-term speculation. This has not only been successful in drawing in HNWIs by 2025, over 9,800 millionaires are projected to have settled in the UAE, but it has also influenced the transformation of the expatriate population from tenant to owner.

Dubai real estate supply 2026: deconstructing the delivery wave

When the market looks that far ahead, the talking point among institutional analysts is how balanced supply and demand will be. After years of breakneck appreciation, most analysts are predicting a move toward a more balanced and sluggish growth stage, as many new homes are still in the pipeline.

The 2026 supply pipeline

Evidence of that is the 120,000 units scheduled for delivery in Dubai in 2026. This would be a significant jump from 30,000 units delivered in 2024 and an anticipated 90,000 next year. Nonetheless, given historical completion rates, the actual deliveries will probably be fewer. From 2022 to 2024, just about 56 percent of the planned units had been completed on time, but only because a “contractor capacity crunch” and coordination issues got in the way.

| Year | Projected Units | Likely Completion (Adj.) | Market Impact |

|---|---|---|---|

| 2024 | 30,000 | ~25,000 | Supply scarcity |

| 2025 | 90,000 | ~50,000 | Balanced demand |

| 2026 | 120,000 | 60,000 – 70,000 | Moderation in gains |

Knight Frank’s optimistic forecast is for 66,000 homes per annum to be completed from 2026-2030, but that would still represent an outperformance against the historical average of 36,000 units per annum. This increased supply is likely to weigh on rents and price growth, which should slow to around 5-8% in 2026 following surges of 22% in 2024.

Supply segmentation: villas vs apartments

It is a spotty supply picture for 2026. New villa and townhouse launches are still few, with just 15,284 villas due for completion in 2026 against close to 100,000 apartments. This shortage would indicate that villa prices, which have already recorded an increase of 206% since the pandemic in certain localities, are more likely to stay firmer and resilient than apartments. Sideways pressures: In more crowded neighborhoods, apartments may see lateral movement as buyers and renters have access to choices.

Dubai property purchase expenditure and number calculating

Investors need to consider substantial upfront and ongoing costs over and above the price of a property. In Dubai, transaction costs generally amount to between 7% and 8% of purchase prices for completed properties.

One-Time transaction costs

- DLD Transfer Fee: 4% of property value + small admin fee (AED 580). Legally divided between buyer and seller, the buyer normally pays the entire 4% in a seller’s market.

- Agent Fee: Usually, 2% of the purchase price plus 5% VAT.

- Trustee Registration Fee: AED 4,000 excluding VAT for amounts over AED 500,000; and AED 2,000 excluding VAT for amounts valued less.

- No Objection Certificate (NOC): This may vary from AED 500 to AED 5,000 and must be paid on developers.

Mortgage-Related costs

All who are seeking bank finance, extra fees added:

- Bank Arrangement Fee: Typically, 1% of the loan amount and VAT.

- Property Valuation Fee: AED 2,500 to AED 5,000 net of VAT.

- Mortgage Registration Fee: 0.25% of the loan amount + AED 290 admin charge.

- Ongoing ownership costs

- Charges: Yearly fees collected for maintenance of common areas, under the RERA’s service charge index. The rates vary between AED 10 and AED 35 psf. ft for flats and between AED 2 and 6 per sq. ft for villas.

- Dubai Municipality Housing Fee: 5% of annual rent, paid monthly with the DEWA utility bill.

- Insurance: You will need to take on property insurance (0.1% to 0.3% of the value) and life insurance (0.4% to 0.8% of the decreasing loan balance), usually through your lender.

The interest rate outlook 2025-2026

The Central Bank of the UAE (CBUAE) follows in the footsteps of its US counterpart take into account that 1 AED equals 0.27 USD, hence their moves are synchronized when it comes to monetary policy. The CBUAE has slashed its base rate to 3.65% in late 2025. Markets expect another 75 to 100 basis points of easing in 2026, which would move mortgage rates closer to 3.0%. Given that falling rate regime, the DBR is likely to improve for buyers, in turn, helping in heightening the demand levels in mid-market spaces.

Pakistan vs. Dubai investment post-COVID: Strategic ROI analysis

For Pakistani capital, the decision to invest in property in their home country or in Dubai is frequently a tug-of-war between entry barriers and long-term stability.

Return on Investment (ROI) comparison

Pakistan’s returns are commonly from 3% to 6%, while Dubai gives some of the highest rental returns globally of between 6%-10%. In Dubai, these returns are tax-free at the source as opposed to Pakistan, where investors pay changing tax statuses (Filer vs. Non-Filer) that put them at a higher risk for political instability and depreciation of money.

TAX POSITION OF PAKISTAN Investors FBR Rules 2025-2026

Tax Reliefs for Overseas Pakistanis Pakistan Irfan Shaukat Mushtaq 2025 Under the Finance Act, 2025 vide circular no. 1 of FBR, certain beneficial provisions have been introduced in the ordinance to facilitate overseas investors. However, NICOP/POC holders, non-residents (staying less than 183 days in Pakistan), are entitled to “filer rates” on property transactions in Pakistan, but are non-filers in the database.

| Transaction Type | Filer Rate (POC/NICOP) | Non-Filer Rate |

|---|---|---|

| Buying (Value < Rs50M) | 1.5% | 10.5% |

| Buying (Value > Rs100M) | 2.5% | 18.5% |

| Selling (Value < Rs50M) | 4.5% | 11.5% |

| Selling (Value > Rs100M) | 5.5% | 11.5% |

Resident Pakistanis must disclose foreign property income and assets if the value of the property exceeds $100,000 or the income on it is in excess of $10,000. Failure to do so may result in penalties of up to 3% over the value of the asset.

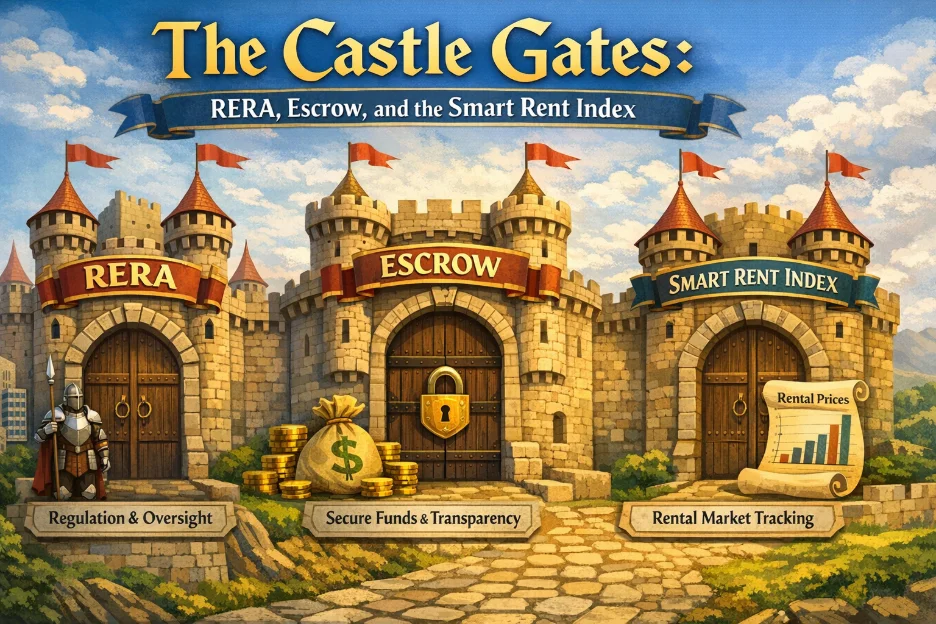

The castle gates: RERA, Escrow and the Smart Rent Index

Dubai’s market has grown post-COVID based on a strict legal system aiming to eradicate the speculative balloons that inflated over previous decades.

Off-plan safeguards: Oqood and Escrow Laws

ALL off-plan development has to be registered at the DLD on the Oqood system, which offers interim registration for property rights until completed. Developers are mandated by law to establish an Escrow Account specifically for each Project. Buyer payments are only released upon verified construction milestones being achieved, meaning that funds are ring-fenced for the project at hand.

025 Smart Rental Index and Star Ratings

In January 2025, the DLD introduced its Smart Rental Index, which applies AI to issue ratings for buildings on a one- to five-star scale. This apparatus departs from location-based references to condition-based pricing. Anything that requires structural changes and upgrades is to be disclosed in Emari by landlords. You can legally increase the asking rent if the building rating or unit rating is higher, given lease has completed 1 year in the system. Poor maintenance can still force owners by law to make reductions.

A Cross-Border Case Study To Overcome the Impasse

Challenge: Mr. Zubair, an experienced entrepreneur from Lahore, wanted a Pakistan vs Dubai investment post-COVID comparison. He was worried about high tax rates (18.5%) in Pakistan for non-filer people for expensive houses, as well as the devaluation of the Rupee. He was looking to secure a UAE residency as an investment in the form of property for his family. Still, he was turned off by non-resident mortgage UAE processes and felt “overwhelmed” with the risk of “additional costs” sometimes tied to off-plan properties in foreign markets.

Solution: Zubair contacted PFOC Properties. Aware of the lack of a guaranteed hedge, PFOC was his “final bridge.” You went through a” stringent analyzation process” of his portfolio and found this “high yield off-plan project in JVC with a 7-year post-handover payment plan”. PFOC took care of the entire Dubai property purchase cost breakdown for us, so there were no nasty surprises. As our founder is an international tax advisor, we have managed to structure the investment in such a way that it complies with the AML/KYC laws of the UAE and declaration rules of FBR, Pakistan, so that he may benefit from “filer rates” for his future transactions as a non-resident in Pakistan. Our partner bank performed its non-resident mortgage UAE pre-approval for us at a 50% LTV against an off-plan property.

Case study: Zubair bought and had his off-plan property increase in value during construction, and on top of that, successfully found himself a 10-year Golden Visa. Drawing on PFOC’s accountancy expertise, he minimized his tax position around the world and returned a potential 7.8% rental yield.

Client Quote:

“PFOC Properties made their red-tape nightmare an overnight piece of cake.” I had someone on the ground in Dubai who cared about saving me a dollar or two on tax as much as getting me good returns, which made being located in Lahore much more comfortable. They are not just agents but strategic advisors who gave me the confidence to invest my capital into a strong currency. “At last, I have peace of mind for my family and me with a Golden Visa.

_” The Pakistani Investor & PFOC client, Zubair A.

AML and KYC compliance by 2026

The UAE has implemented great improvements to its AML legislative framework, so it can continue amid challenges as a clean and connected global financial center. Real estate agents, brokers and developers fall under the purview of Designated Non-Financial Businesses and Professions (DNFBPs) and are considered a first line of defense in the financial system.

Mandatory transparency pillars

Pursuant to Federal Decree-Law No. (10) of 2025, the compliance test has moved from “actual knowledge” to that of “should have known.” The excuses for real estate professionals are becoming less and less substantial.”

- CDD (Client Due Diligence): In the CDD process, agents must identify the buyer and seller as well as the UBO.

- Source of Funds: Proof that funds used in transactions are not illicit shall be verified by investors.

- Verify and subscribe Registered Reports Suspicious Transaction Reporting (STR) Any cash transaction over AED 55,000 or transacting in a virtual asset at a threshold of AED 55,000 is required to be reported using the goAML system.

- Recording: Business entities are required to keep copies of the transactions and CDD information for a minimum of five years.

Non-compliant entities could face punitive measures between AED 50,000 and AED 5 million, besides criminal responsibility or suspension of license.

- The role PFOC Properties could play

There should be more to offering a tour in today’s rapid real estate market than simply being a broker; it should hint at having a strategic partner. As one of the best real estate brokerages in Dubai near me, PFOC Properties closes that void between local knowledge and international financial security.

Why chosen us

- Expert Advice: YES, we give a detailed overview of the market in the UAE to stay ahead with regards to high-ROI luxury, mid-market, and affordable residential globally.

- Tax and Legal Advisory: Using our niche area of expertise in international tax, we assist investors (mainly from the UK) with FBR regulations and cross-border asset protection.

- Channel Partners: Do you have Vyom real estate broker-approved partners in the region? We are linked with all the top 18 developers in Dubai, giving us access to ultra-luxury properties with Omniyat as well as affordable mid-market ones.

- Complete Residency Support: We cover your entire UAE residency via real estate, from purchasing to Golden Visa paperwork.

FAQs

How has Dubai property price growth shifted since COVID in key communities?

The growth has been strong, but now appears to be slowing. Properties in Dubai’s Palm Jumeirah can expect an average increase of 31% annually by 2025, as compared to the mass market average per square foot rate of AED 1,537.

Have Dubai rental yields increased after COVID, and where are landlords earning most?

Yes, rates are still some of the highest in the world (6-9%). Areas like Jumeirah Village Circle (7.87%) and Dubai Investment Park (up to 10.5%) are the top performers.

Is off-plan property in Dubai still safe after COVID, and what are the risks?

By Escrow Law and Oqood registration UAE real estate market is highly regulated and secure. The major risk, however, remains the delay in project completion for which RERA now has a legal provision for compensation.

What are the main post-COVID demand drivers for Dubai real estate?

The 10-year Golden Visa and the in-between HNWI human flow (9,800 millionaires by 2025), as well as big-ticket infrastructure projects such as the new Metro Blue Line extension, are leading the charge.

What will the impact of interest rates and mortgage rules be on Dubai property affordability for 2025–2026?

The DBR has been improving on the back of falling interest rates (expected to fall towards 3.0% by 2026), which gives people more room to move from rental properties to homeownership, a plus point for demand!

What is the Dubai property supply pipeline, and could an oversupply lead to a drop in prices?

More than 120,000 units are forecast for 2026. This increased supply should help keep price appreciation in the modest range of 1-5% per year, rather than go negative.

What property types are doing best post-COVID: apartments, villas or townhouses?

Villas and townhouses have vastly outperformed apartments due to a lack of stock in established areas, with prices doubling in places since 2020.

What are the hidden costs in Dubai property investment?

In addition to the cost, prepare for a 4% DLD fee, 2 per cent agent commission, AED 4,200 trustee fees and a recurring EMI/interest applicable to mortgage holders at an interest rate reflective of EIBOR plus a margin. Minimum life cost may vary based on the housing floor to be charged through utility/service providers.

What would an investor need to look for before purchasing a Dubai off-plan unit?

Investors should check the project’s RERA registration and ensure that all payments are deposited into a Real Estate Regulatory Agency (RERA) approved, project-specific escrow account.

What are the legal protections for buyers in off-plan Dubai (escrow, Oqood, RERA rules)?

No 8 of 2007 (Escrow Law) to protect the funds for construction and Oqood, for interim ownership registration. RERA mediates all developer-buyer disputes.

How handover delays impact ROI and what SPA clauses buyers need to keep an eye on?

Delays can postpone rental income. Flipping buyers should also look into the Sales and Purchase Agreement (SPA) for the “grace period” (typically 6–12 months, i.e., how long it will take until they risk late-delivery penalties, which can often be as high as 1% of property price/quarter).

Conclusion: the future for Dubai real estate in 2026

Post-COVID Dubai property market evolution is a testament to the structural drift towards stability, transparency and institutional-grade maturity. The rapid across-the-board price increases of 2022-2024 are likely to moderate after a large supply (up to 120,000 units) comes on the market in 2026, yet underlying fundamentals are still extremely favorable. Sustained population growth, low interest rates and best-in-class regulation will mean that Dubai continues to be the leading location for global wealth preservation and high-return real estate investing. Investors thinking longer term are also well-positioned to consider the 2026 picture of “calm and steady” growth, underpinned by a clear belief that “the best locations will always outperform, that lifestyle matters more than it ever did before,” as you see investor appetite divided increasingly into quality of location, attractiveness of lifestyle but also strict adherence to what’s increasingly evolved stable legal standards operating in an emirate many have known for decades.