How to Buy Dubai Property for Golden Visa (Pakistani Investor Guide) 2026

Introduction

The rupee keeps losing value every month, and your savings buy less each year because of inflation. The Dubai property golden visa Pakistan program fixes two big problems at once. You get a safe place to keep your money, and you also get 10-year residency in Dubai for your entire family.

This guide shows you exactly how the golden visa UAE property Pakistan system works. You will learn which homes qualify and what papers you need. Most importantly, you will see why Pakistani families are choosing this path right now and how you can do the same.

When you buy property Dubai from Pakistan, you move your money into AED which links to the US dollar. While the rupee slides, your Dubai property holds steady and even grows in value. You pay zero income tax and zero tax when you sell. Rental income gives you 7-10% returns each year, which is why smart investors are moving fast.

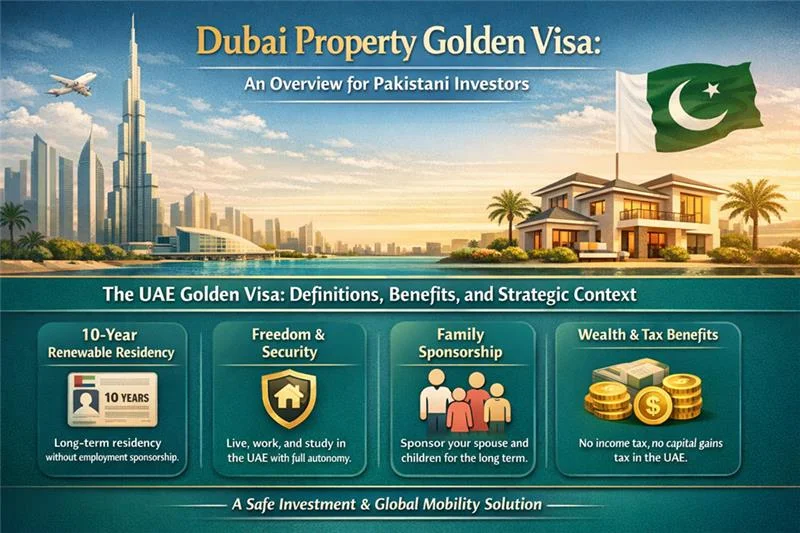

What Is the UAE Golden Visa?

The UAE Golden Visa gives you 10 years of residency, and you do not need a job to get it. You do not need an employer to sponsor you either. The Dubai property investment visa makes you your own boss, so you can work anywhere, start a business, or simply live in peace with your family.

Key Benefits of Golden Visa for Pakistani Families

The visa lasts 10 years and you can renew it when it expires. You can leave the UAE for months or even years and your visa stays valid, which is perfect for business people who work across multiple countries. Your family gets the same benefits too, with daughters staying covered at any age and sons covered until age 25.

Financial Advantages and Banking Benefits

Banks treat you much better when you have a Golden Visa. They see you as a real resident rather than a worker who might leave soon, which means you can get better loans at lower rates. This saves you thousands of dirhams over the years.

The golden visa property rules in the UAE also give you the Esaad card that provides 20-50% off at hotels, hospitals, and schools across the UAE. Many families save thousands each year with these discounts alone. If you want to learn about other visa options through property investment, our blog covers various pathways for Pakistani investors.

The AED 2 Million Rule Explained

You need property worth at least AED 2 million to qualify. But here is the trick that many people miss the Dubai Land Department looks at market value today, not what you paid years ago. Let me show you how this works.

How Property Valuation Works for Golden Visa

Say you bought a flat in 2021 for AED 1.7 million. Today, the same flat is worth AED 2.2 million because prices have gone up. You still qualify for a Golden Visa because you just got a new valuation paper from DLD showing the current worth.

Combining Multiple Properties to Reach AED 2 Million

You can also add multiple properties to reach the threshold. Own three flats worth AED 700,000 each? That is AED 2.1 million in total, and you qualify. Own half of an AED 4 million villa with your wife? You both qualify because the total value exceeds AED 2 million.

Which Homes Work for Golden Visa

Not all Dubai property works for the UAE golden visa requirements, Pakistan path, so you need to be careful about where you buy. You must buy in “freehold” areas where foreign nationals can own 100% of the property. Areas like Downtown Dubai, Dubai Marina, Business Bay, and JVC all work perfectly.

Ready Properties vs Off-Plan Properties

Ready homes give you the fastest results. You buy the home and get your Title Deed right away, which lets you apply for your visa the same week. Developers like Emaar Properties, Damac, and Aldar have many ready homes available across Dubai’s best locations.

The off-plan property golden visa path works equally well if you want to save money. These are homes still being built and projects from Azizi Developments, Binghatti Properties, and Sobha Properties, which often cost 20-30% less than ready homes. You can apply for your visa once you get your Oqood paper, even while builders are still working on the project.

Commercial Properties for Golden Visa

Office and shop spaces also work if they are valued at AED 2 million or more. This helps business owners who want to buy their office and get residency in one move.

New Mortgage Rules Help a Lot

The rules changed dramatically in 2024-2025 and this makes it the best time ever for Pakistani investors. Before, you had to pay 50% in cash upfront. Now you can get a bank loan for up to 80% of the price and you only need to pay 20% yourself. The total property value is what matters for Golden Visa eligibility, not how much cash you personally put down.

How Mortgages Help Pakistani Investors

This is a game-changer for Pakistani people who face money transfer limits from the State Bank. Instead of sending AED 2 million at once, you send AED 500,000 for the down payment, and a UAE bank gives you a loan for the rest. You just need a letter from your bank confirming the financing.

Papers You Need for Golden Visa UAE

Getting the right papers stops most Pakistani people before they even start. The paper trail is not hard if you do it in the proper order, but miss one step, and you start over from scratch.

Complete Attestation Process from Pakistan

Start at your local Union Council or hospital where they attest your marriage certificate and kids’ birth certificates first. Then go to the MOFA Pakistan in Islamabad, Lahore, or Karachi for the next level. The UAE Embassy in Islamabad or Karachi checks the papers next. Finally, MOFA UAE in Dubai puts the last stamp on everything.

This takes 2-3 weeks if you know what to do and have all documents ready. Most people take 6-8 weeks because they make simple mistakes or miss requirements. Working with experts like PFOC Properties saves you a lot of time and stress since we handle this process daily for Pakistani families.

Papers You Must Have

Your passport must be valid for at least 6 more months. Your Title Deed or Oqood must show your name exactly as it appears on your passport because even small spelling mistakes cause delays. You need your marriage certificate with all stamps even if your wife is not coming with you initially.

Kids’ birth certificates need all the same stamps and attestations. If you got a bank loan for the property, you need an official letter from the bank. People already living in the UAE need to show their Emirates ID card. Everyone needs passport photos with a white background.

How to Buy Dubai Property Step by Step

Step 1: Pick the Right Area

Jumeirah Village Circle works great for Pakistani people. Properties from Azizi give you 8-10% rental yields each year and prices also go up 5-7% annually. If you invest AED 2 million here, you get AED 160,000-200,000 in rental income each year. Good projects include Azizi Milan, Azizi Venice, and Azizi Leily.

Best Areas for High Rental Returns

Business Bay is better if you want your property value to grow faster. Capital appreciation here is 10-15% each year though rent is slightly lower at 6-8%. Binghatti builds a lot here with projects like Binghatti Aquarise, Binghatti Amber Hall, and Binghatti Twilight.

Family-Friendly Communities

Dubai Hills Estate is perfect for families who want good schools nearby. Emaar builds most homes here, and while rent is 6-7%, the area is very nice with parks, shops, and community facilities.

Budget-Friendly Investment Zones

Motor City and Dubai South cost less to start, which makes them ideal if you want to buy two or three smaller units to reach AED 2 million. Samana has projects like Samana Hills South and Samana Sky Views.

Luxury and Affordable Developer Options

If you want luxury living, Sobha Properties builds beautiful homes in MBR City. Look at Sobha Orbis and Sobha Siniya Island. For cheaper options, Danube Properties offers good quality at fair prices with projects like Bayz 102 and Diamondz. You can explore our full portfolio of properties to compare options across all these developers.

Step 2: Send Money the Legal Way

State Bank of Pakistan has strict rules that you must follow. All money must go through legal banking channels using the proper Form M documentation. You fill out Form M papers, the bank checks everything, and then sends the money through official channels.

Wire Transfer Process and Timeline

Wire transfer takes 2-3 days once the bank approves. Getting that approval can take 1-2 weeks if your papers are not perfect. State Bank scrutinizes large transfers carefully and will ask where your money came from, so be prepared with solid documentation.

Warning: Avoid Illegal Money Channels

Never use Hawala or Hundi, even though they are faster and might cost less. They are against the law and Dubai authorities check where your money came from very carefully. If they catch you using illegal channels, your visa gets rejected immediately, and you lose everything.

Step 3: Sign Papers and Get Title Deed

Once your money reaches Dubai safely, you sign the Sales Agreement at the DLD office. You pay the 4% transfer fee to DLD, which is AED 80,000 for a AED 2 million property.

Digital Title Deed Process

DLD gives you your Title Deed the same day for ready homes. The deed is digital now so you cannot lose it or damage it. For homes being built, you get an Oqood paper until the building is completed.

Step 4: Apply for Your Visa

DLD Cube makes everything digital now. You upload all your stamped papers, your property valuation paper, and your photos. The system checks everything automatically.

Medical Tests and Biometrics

You go to an approved clinic for a health check. They screen for diseases and take X-rays and blood tests. Results go to the visa system within 24 hours. Then you go give your fingerprints and eye scans for Emirates ID, which takes about 30 minutes.

Expected Processing Timeline

The golden visa processing time UAE is typically 7-10 days if all your papers are correct. If papers are missing or wrong, you wait 2-4 weeks more while you fix everything.

Total Cost of Dubai Property Visa Pakistan

Most people only think about the AED 2 million for property. You need extra funds for other costs that add up to 6-8% more than the purchase price.

One-Time Purchase Costs

DLD charges 4% to transfer the property, which is AED 80,000 on AED 2 million. Agent fees are typically 2% plus tax, which comes to about AED 42,000. Just these two costs alone total AED 122,000 beyond your property price.

Visa and Documentation Fees

Your visa application costs about AED 9,885 for the full 10-year period. Each family member costs AED 3,000-5,000 more to add. Health checks cost AED 300 per person and Emirates ID costs AED 370 per person.

Getting papers stamped in Pakistan costs anywhere from PKR 7,000 to PKR 100,000 depending on family size. Most people spend PKR 30,000-50,000 for the whole family.

Annual Maintenance Costs

Every year, you pay building maintenance fees that typically cost AED 15-30 per square foot. A 1,500 square foot flat costs AED 22,500-45,000 per year for cleaning, security, and common area maintenance.

Why Dubai Beats Pakistan for Property

The difference is huge when you look at the facts. Dubai has clear, transparent rules and almost no corruption in property deals. Pakistan has messy court cases that can drag on for years.

Currency Stability and Property Appreciation

Your money stays safe in Dubai. The AED does not lose value like the rupee does. In the past 5 years, the rupee lost 50% of its value against the dollar. Dubai property prices went up 30-40% in the same period.

Zero Tax Benefits

Tax treatment is the biggest financial win. Pakistan takes up to 45% of your rental income if you are a high earner. Dubai takes zero. Pakistan takes 15% capital gains tax when you sell property. Dubai takes zero again. Over 10 years, the tax you save can be more than what you paid for the property.

Easy Access and Strong Pakistani Community

Dubai is only 3-4 hours away by plane. You can visit your property or family easily with flights going multiple times every day. Over 1.5 million Pakistani people already live in Dubai. You can find Pakistani food, schools teaching in Urdu, and mosques everywhere. For more insights on why Dubai attracts Pakistani investors, check out our blog for market analysis.

Case Study: Securing a Future Through Smart Investment

Muhammad runs a textile business in Karachi. He watched his profits shrink as the rupee fell and taxes kept going up. His three kids needed good schools and a safe future. Inflation ate his savings faster than he could earn them.

The Investment Strategy

He worked with PFOC Properties to find two flats in JVC worth AED 2.3 million total. This gave him safety above the AED 2 million minimum. Both flats came from Azizi Developments, a builder that PFOC had checked carefully.

He paid the money over 8 months as the building was being built. This kept each bank transfer small enough to avoid problems with State Bank. Everything stayed legal and clean.

PFOC handled all the paper stamping through their Pakistan partners. Muhammad only went to Dubai once to sign final papers and give his fingerprints.

Financial Results and Family Benefits

The two flats now generate AED 184,000 in rental income each year and he pays zero tax on this money. In rupees, that is about PKR 15 million per year. In Pakistan he would lose 35-45% to tax and keep only PKR 9-10 million.

His visa came in 8 days. His wife and three kids all got visas too. Now the family lives partly in Karachi and partly in Dubai. The kids go to good schools in Dubai while Muhammad runs his business in both cities.

Client Testimonial

“Partnering with PFOC Properties was the best decision for my family’s security. They navigated the complexities of international banking and legalities seamlessly. It truly secured our future.” — Muhammad

How PFOC Properties Helps You

PFOC Properties connects Pakistan and Dubai for investors. Started by Aurangzaib Chawla, the company knows both countries well. They work with all big developers.

PFOC works with Emaar, Damac, Aldar, Azizi, Binghatti, Sobha, Ellington, Danube, Samana, Tiger Group, Union Properties, and MAG Property.

The team has Pakistani tax experts who know State Bank rules inside out. They make sure your money moves legally. Every dirham gets tracked properly with full papers.

Your Action Plan for Success

The Dubai property golden visa Pakistan path gives you financial safety and personal freedom. Start by checking State Bank limits for sending money abroad and gather all your papers early. Look at different areas across Dubai to find what matches your goals.

Pick trusted developers like Emaar, Damac, Azizi, and Sobha who deliver projects on time. Start getting your papers stamped early since it takes 2-3 weeks to complete the full chain.

Buy property worth 20% more than the minimum. If you need AED 2 million, buy property worth AED 2.4 million to stay safe if values change. Never use illegal money channels. Legal banks take longer but protect your investment.

Work with people who know both Pakistan and UAE well. PFOC Properties handles this process every day for Pakistani families and can guide you through each step.

FAQs (Frequently Asked Questions)

What is the minimum property value golden visa in 2026?

You need property worth at least AED 2 million to qualify. The DLD checks value using either Title Deed or market value paper. You can use one property or add many properties to reach this amount. Contact PFOC Properties to check if your property qualifies.

Can Pakistani people buy property Dubai from Pakistan for Golden Visa?

Yes, Pakistani people can buy freehold property in Dubai and get Golden Visa. You need money to buy property worth AED 2 million and pass background check.

Does off plan property golden visa work for new buildings?

Can resale property golden visa UAE give fast visa?

Yes, ready homes are fastest way to get Golden Visa. Once you have Title Deed showing AED 2 million value, visa comes in 7 to 10 days. Ready homes also give rent money right away.

Is mortgage allowed golden visa under new rules?

Yes, 2024-2025 rules removed cash-only requirement. You can use bank loan for any amount. Property must be worth AED 2 million total. You just need NOC from UAE bank showing you have loan.

Does joint property golden visa UAE work for married couples?

Yes, husband and wife can own one property worth AED 2 million together. Both get Golden Visa from one property. This saves money because you only need to buy one home.

What documents for golden visa UAE do Pakistani investors need?

You need a passport for 6 months, Title Deed or Oqood, marriage and birth papers with UAE stamps, photo, and bank NOC if property has loan. PFOC Properties helps get all papers ready before applying.

What is the Dubai property purchase process from Pakistan?

Pick freehold property worth AED 2 million or more from areas like JVC or Business Bay. Send money through SBP legal banks. Sign Sale Agreement. Pay 4% DLD fee. Get Title Deed. Apply for visa through DLD Cube.

How long is golden visa processing time UAE after buying property?

After giving all correct papers to DLD Cube, visa comes in 7 to 10 days. If papers have mistakes, it can take 3 to 4 weeks. Work with PFOC Properties to make sure papers are correct.

What is total Dubai property visa cost Pakistan including all fees?

Beyond AED 2 million for property, add DLD fee of 4%, agent fee of 2%, visa fee of AED 9,885, health and ID costs of AED 1,000, and paper stamps. Total extra cost is AED 120,000 to AED 160,000.

Can I get visa before my new building is ready?

Which Dubai areas qualify for Golden Visa property investment?

Can I bring my whole family on the same Golden Visa?

Yes, the main investor can sponsor the wife and all children. Girls stay at any age. Boys stay until age 25. You can also sponsor parents and house staff. Each person needs health insurance.

Why do some Golden Visa applications get rejected?

Common reasons include property value under AED 2 million, papers not stamped right, bad background check, or using illegal money channels. Get papers checked by PFOC Properties before applying.

Can I renew my Golden Visa after 10 years?

Yes, renew for 10 more years if you still own property worth AED 2 million or more. Most Dubai properties have gone up in value over 10 years. Renewal takes only 3 to 5 days.

Can I work at any company with a Golden Visa?

Yes, Golden Visa lets you work at any UAE company or start your own business. You do not need a work visa from your employer. This gives full freedom compared to a normal work visa.